Loan Acquisition Analyst (Underwriter)

Offer summary

Qualifications:

Bachelor’s degree in finance or accounting or equivalent experience in financial analysis., Minimum of 3-5 years of experience in commercial loan underwriting, including transactions over $2 million., Proficiency with MS Office applications., Experience working with loan brokers and familiarity with ordering and reviewing appraisal and environmental reports..Key responsibilities:

- Review and analyze loan applications for compliance with program guidelines.

- Assist in pre-screening property, business, and applicant financials, including NMTC eligibility for Impower loans.

- Manage loan records and data entry within company software, Ventures.

- Coordinate with internal and external parties to ensure timely loan approval and funding.

Job description

About the Organization

The Momentus Capital branded family of organizations - which includes Capital Impact Partners and CDC Small Business Finance and Momentus Securities (an SEC-registered broker-dealer, MSRB-registered, FINRA/SIPC member) - are transforming how capital and investments flow into communities to provide people access to the capital and opportunities they deserve.

We are working to reinvent traditional financial systems and advance locally-led solutions that create economic mobility and generational wealth. Through our continuum of financial, knowledge, and social capital, we offer a comprehensive package of loan products, impact investment opportunities, training and business advising programs, and technology solutions.

Our holistic and streamlined approach offers comprehensive solutions for small business entrepreneurs, real estate developers, community-based organizations, and local leaders at every stage of growth, from inception to expansion. When these leaders have the opportunity to succeed, their communities, their residents – and our country – thrive

Position Summary

This summary is for the full-time Loan Acquisition Analyst position, with no direct reports, working remotely.

The Loan Acquisition Analyst will manage the company’s internal credit decision process and ensure product efficiency for the Impower (non SBA), Morgan Stanley and any other SBA 504 First Trust Deed loan programs through prescreening and credit analysis of applications. The Loan Acquisition Analyst will perform similar analysis of applicants on new loan programs as they are launched and assist with SBA 504 loans (2nd mortgage, as needed). The Loan Acquisition Analyst is to maintain effective communication with Loan Officers, Loan Processors/Closers, CDC management, and Capital Sources to ensure timely loan decision process and ultimate funding of loan applications.

Essential Responsibilities

- Review loan request submissions for acceptability under the program specific (MS, Impower, NYL, City First, Other) credit guidelines. Assist the loan officer with pre-screening of property type, quality and location, working capital, business and personal cash flow, personal credit and debt to worth. For Impower Loans, prescreen for New Market Tax Credit (NMTC) eligibility and Community Impact.

- Management of loan records within company software: Ventures. Data input required including; summary of collateral, loan structure, SBA or NMTC eligibility, loan background, and operating company and affiliate background.

- Assist loan processor with questions regarding loan file document collection.

- Create comparative spreadsheets using data from tax returns and financial statements. Modify spread to reflect the proposed project, mortgages, and future operations. Prepare combined financial statements using Ventures when necessary.

- Analyze spreadsheet for identification of positive and/or negative financial trends, transactions, or events that would have bearing on the future operations and financial health of the applicant company as relates to the proposed loan.

- Work with referral source, applicant or other appropriate party to obtain answers to credit questions and address potential weaknesses.

- Decline applicants that do not meet program specific credit guidelines.

- Prepare written credit memoranda including a financial narrative for submittal to New Markets Support Company, Morgan Stanley or any other specific capital source that is required to approve loans. For Impower loans, prepare any required NMTC eligibility forms.

- Communicate to internal and external parties regarding approval and funding timelines. Work with internal and external parties to resolve issues as they arise.

- Determine which documents are needed (Commitment Letter, Loan Referral Agreement, Master Purchase agreement, NMTC forms), prepare and/or circulate for signatures.

- Order Appraisal and Environmental reports when necessary. Complete initial review and coordinate submission of reports to third party review teams and manage any revisions required. Collect & track deposits received for third party costs and coordinate vendor payments with CDC’s accounting staff.

- Assist Loan Closers in collection of documents needed to sign off on any credit related conditions. Prepare credit memo amendments when loan structure or terms change post approval.

- Confirm premium to be paid by MS to referral source/selling lender, what loan initiation fees are needed to collect along with any CDC referral fee (if necessary).

- Completion of Ventures loan log fields to assist CDC Management with assessing and monitoring turn times both internally and at Morgan Stanley and New Markets Support Company to promote work flow efficiencies.

- Periodic travel to corporate office and events as needed

Requirements

- Bachelor’s degree in finance or accounting or equivalent experience in financial analysis for commercial lending.

- Minimum of 3-5 years of experience in commercial loan underwriting with experience underwriting transactions in excess of $2MM.

- Proficiency with MS Office applications.

- Ability to prioritize, multi-task, and remain organized.

- Strong written and verbal communication skills.

- Experience working with loan brokers preferred.

- Familiarity with ordering & reviewing Appraisal and Environmental reports.

- Ability to underwrite different loan products (SBA & Non SBA)

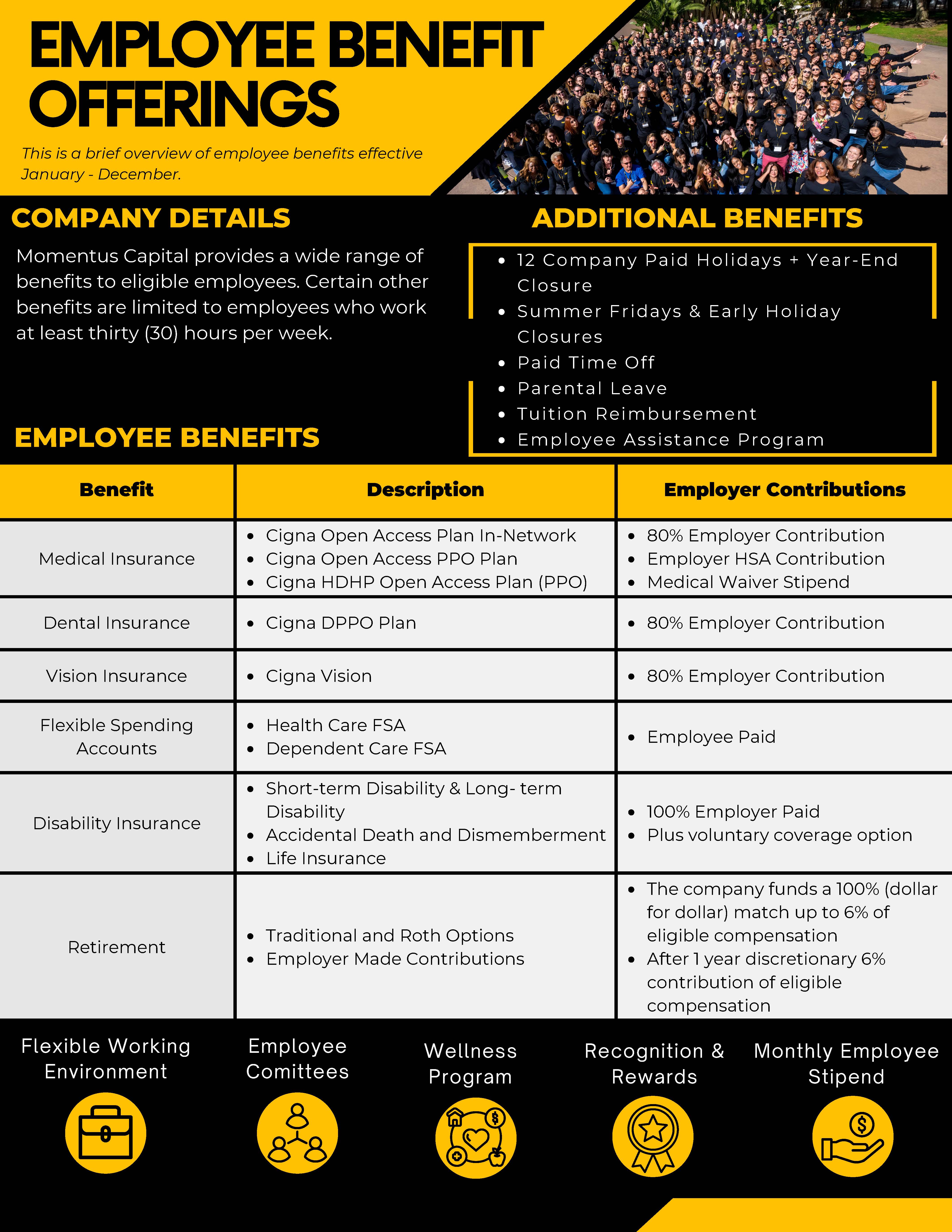

Benefits

The base salary range for this position is $74,828.00 - $93,535.00 per year and is eligible for an annual incentive

This is a Remote Role

All employees must be legally authorized to work in the United States. The Company will not sponsor applicants for work visas.

Required profile

Experience

Other Skills

- Microsoft Office

- Multitasking

- Organizational Skills

- Prioritization

- Communication

Related jobs

LemFi (Formerly Lemonade Finance)

- From: Philippines (Full Remote)

- Full time

Cyrex

- From: Ukraine (Full Remote)

- Full time

Why Knot Travel

- From: United States (Full Remote)

- Freelance

Mazars

- From: France (Full Remote)

- Full time

Anantara Hotels & Resorts

- From: Oman (Full Remote)

- Full time